child tax credit 2022 extension

Web One question tens of millions of Americans are asking is whether the monthly child tax credit that was put in place during the COVID-19 pandemic rescue will be. Web The child tax credit benefit under the American Rescue Plan begins to phase out at incomes of 75000 for individuals 112500 for heads of household and 150000.

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Filing Taxes

Ad The US Tax Filing Deadline was April 18 2022.

. 1406 ET Dec 27 2021. Get Your Past-Due Taxes Done Today. Ad Download or Email More Fillable Forms Register and Subscribe Now.

Web That legislation increased payments for the Child Tax Credit to 3600 for eligible children under 6 and 3000 for children between the ages of 6 and 17. Web Child tax credit extension 2022 when is the deadline and will there be payments next year. File a Late 2021 Tax Return Directly to the IRS.

935 ET Dec 29. Web Through the 2021 Enhanced Child Tax Credit families were able to receive 3600 for children under 6 years of age and up to 3000 for children between ages 6 to. Income tax deadline is.

Child Tax Credit extension. Web Have been a US. Web The child tax credit benefit under the American Rescue Plan begins to phase out at incomes of 75000 for individuals 112500 for heads of household and 150000.

Web 2022 Child Tax Credit Extension2022 Child Tax Credit Extension. However that only applies. Web Heres what you need to know about filing extensions The Child Tax Credit and more.

Web As Congress failed to agree on a Child Tax Credit extension payments will return to 2000 for 2022. The enhanced Child Tax. Child Tax Credit extension 2022.

This money was authorized by the american rescue plan act which. Web Child tax credit payment schedule 2022as such the future of the child tax credit advance payments scheme remains unknown. Web The child tax credit benefit under the American Rescue Plan begins to phase out at incomes of 75000 for individuals 112500 for heads of household and 150000.

Web One provision tens of millions of American families likely want to know is whether the expanded child tax credit implemented in July will continue into 2022As. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all. The expanded Child Tax Credit came to the aid of many households in the United States during the COVID-19.

Web The child tax credit benefit under the American Rescue Plan begins to phase out at incomes of 75000 for individuals 112500 for heads of household and 150000. Web Part of the American Rescue Plan passed in March the existing tax credit increased from 2000 per child to 3600 per child under the age of 6 with 3000 for. The Leading Online Publisher of National and State-specific Legal Documents.

How much have gas prices increased in 2022. However Republican Senators Mitt Romney Richard Burr and. April 8 2022 410 PM PDT.

Web The child tax credit benefit under the American Rescue Plan begins to phase out at incomes of 75000 for individuals 112500 for heads of household and 150000. Web The credit has been found to be effective at reducing poverty. 0 Federal 1499 State.

What S The Most I Would Have To Repay The Irs Kff

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Parents Guide To The Child Tax Credit Nextadvisor With Time

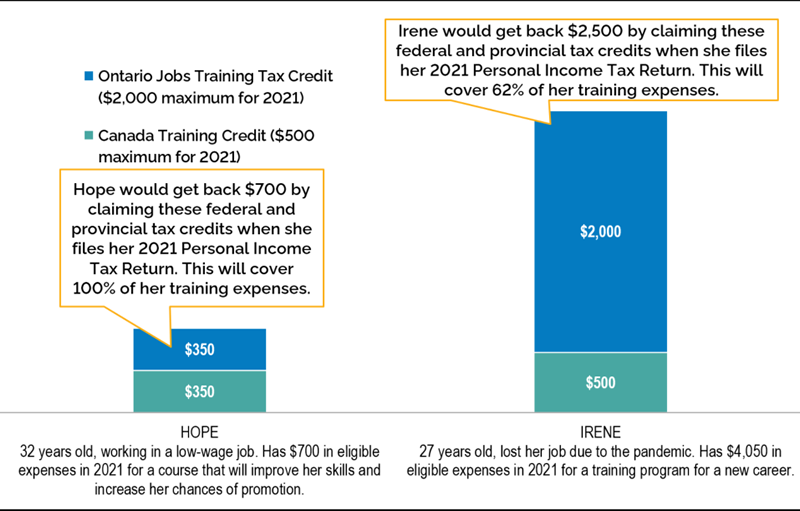

Ontario Jobs Training Tax Credit Ontario Ca

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Rising Food And Energy Prices Underscore The Urgency Of Acting On The Child Tax Credit Center On Budget And Policy Priorities

The Advance Child Tax Credit 2022 And Beyond

Solar Investment Tax Credit To Be Extended 10 Years At 30 Pv Magazine Usa In 2022 Tax Credits Credit Score Investing

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Child Tax Credit 2022 Eligibility And Income Limits For 2022 Ctc Marca

The Politics Of The Child Tax Credit The American Prospect

/cdn.vox-cdn.com/uploads/chorus_asset/file/23392681/1235261204.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

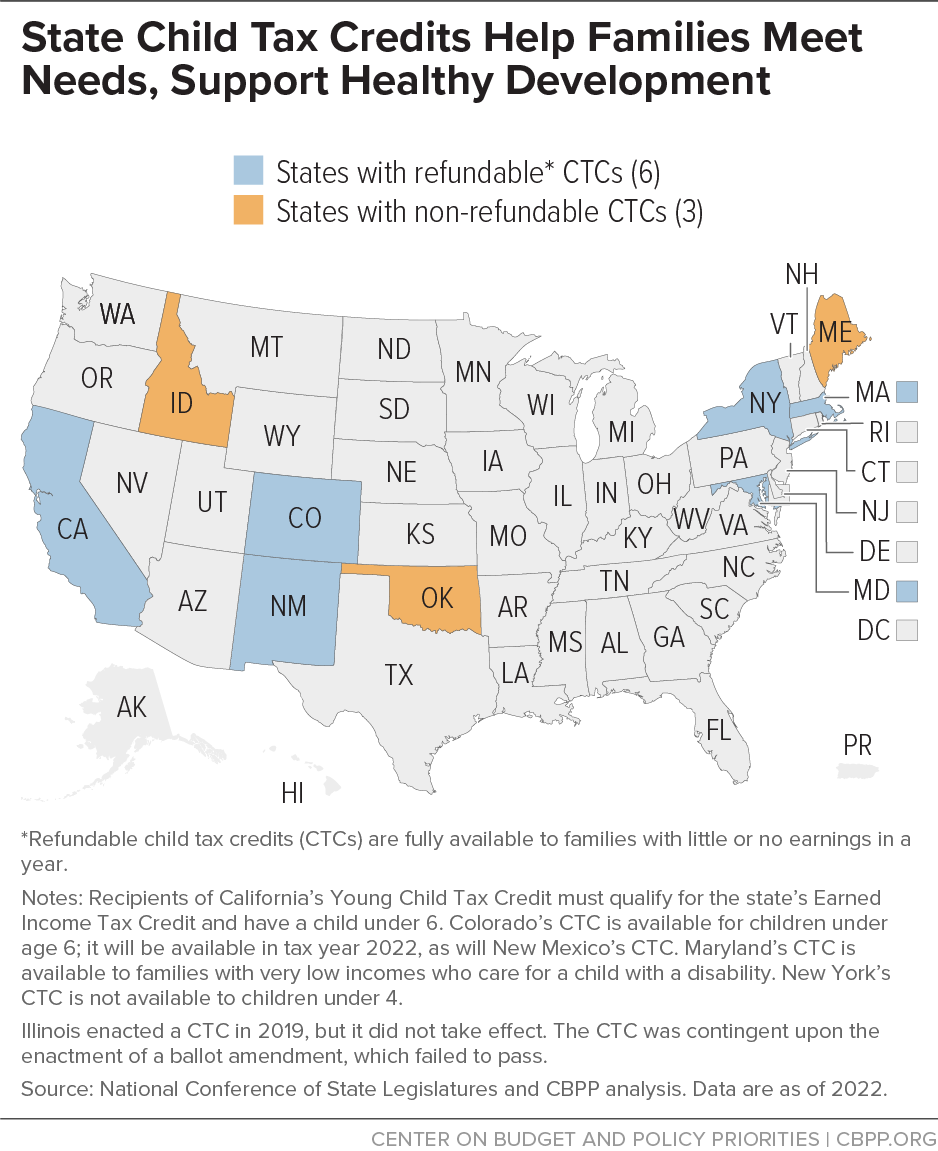

States Should Create And Expand Child Tax Credits Center On Budget And Policy Priorities

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Claim Ertc Rebates Fast Free 2022 Eligibility Test Guaranteed Maximum Refunds In 2022 Tax Credits Free Rebates

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Tax Tip Tuesday In 2022 Tax Deductions Tax Payment Federal Income Tax