tax on unrealized gains crypto

Ordinary income Short-term capital gains Long-term capital gains. If your taxable income is less than 80000 your long-term gains are in fact not taxed at all.

Bidens fiscal 2023 budget request would impose a 20 minimum tax on the unrealized capital gains for households worth at least 100 million - aka its only for Ultra Rich class.

. The rate of capital gains tax is typically 15 on profits. An unrealized gain is an increase in the value of the crypto you hold and an unrealized loss is a decrease in that value. Speaking on CNNs.

Congress have their way wealthy investors may be taxed on those unrealized gains the price appreciation of their assets. 1 Top Pick Koinly 50 Audit Trail. How much do I owe in crypto taxes.

The tax would apply to all property which includes stocks real estate gold and even cryptocurrencies like bitcoin. The long-term capital gains tax rate in the US is either 0 15 or 20 depending on your total ordinary income. For example if you bought 1 BTC for 30000 and the price of BTC has increased to 40000.

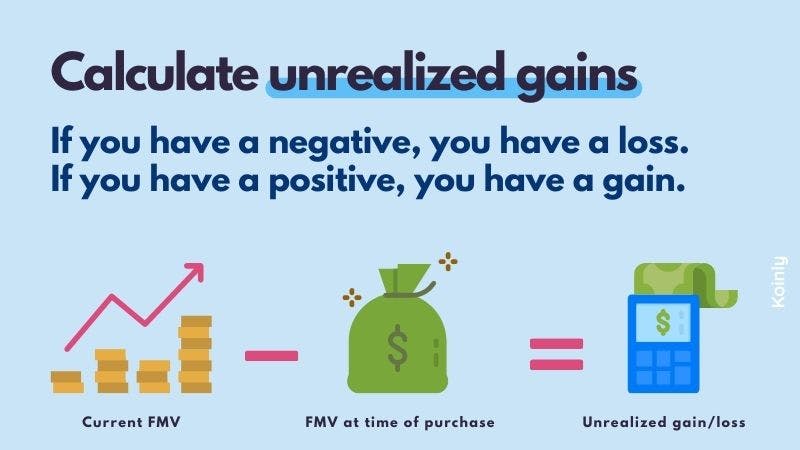

And your losses can carry over to your ordinary income like W-2 income or self-employment. Cryptocurrency is not looked at by the IRS as currency but rather as property. This is also known as an unrealized gain or unrealized loss.

Biden is proposing to increase the highest long-term capital gains tax rate from 20 to 396 for those who make over 1 million dollars of income. You know what youve bought it for and the value of the asset has changed but you still own it so any loss or profit from the asset is not yet realized. It could also mean that appreciation in property prices could also be taxed even before the property has been sold.

Comparing the two charts these rates are lower than the short-term. If Yellen and the US. The tax could make use of a âœmark to marketâ methodology which measures the fair value of assets whose worth can fluctuate over time quite possibly including crypto.

Treatment of crypto losses. October 24 2021 1056 PM. These are currently taxed at 0 15 or 20 depending on your income and filing status.

The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains. Sponsored However part of the proposals included a tax that could be applied to unrealized capital gains. You dont need to pay taxes on unrealized gains and you cant use unrealized losses to offset realized gains.

We all know that the government has proposed taxing unrealized crypto gainsas in taxing our crypto portfolios that we havent profited on. However if household income exceeds 479000 for married couples or 425800 for individuals then the rate of capital gains tax is 20. The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that U.

Is exploring plans to tax unrealized capital gains sparking fierce criticism on Crypto Twitter. Long-term gains are applied to crypto-assets that have been held for 366 days or more. On the other hand if you sold your crypto after holding it for over one year these gains would be taxed at the long-term capital gains tax rate separate from your ordinary income.

Offset gains with losses. The gains and losses arent realized yet because you havent sold traded or otherwise disposed of your crypto. This tax hike would negatively impact.

The IRS considers cryptocurrency as property for tax purposes. It allows you to have a preview of your capital gains tax for free and you can even track your expected capital gains on crypto over time rather than getting a surprise once tax season rolls around. The proposed 20 tax on unrealized gains put forward by the US Department of Treasury s 2023 Revenue Proposal could potentially become a penalty for being successful according to Shehan Chandrasekera Head of Tax Strategy.

Speaking to CNN on Sunday the former Federal Reserve chair said the measures would target liquid assets held by extremely wealthy individuals. Typically if you held cryptocurrencies for less than a year gains are taxed at your normal income rate. You have an unrealized profit of 10000.

The rates of crypto taxes depend on the holding period of the asset and can be categorized into two groups. This means that holders of cryptocurrency or stocks could be taxed on increases before they have even sold the assets. A Bigger Concern Treasury Secretary Janet Yellen has revealed that the US.

Tax is only incurred when you sell the asset and you subsequently receive either cash or units of another cryptocurrency. Koinly is a crypto tax software that helps you produce a crypto tax report with just a few minutes of work. At this point you have realized the gains and you have a taxable event.

If youre holding crypto theres no immediate gain or loss so the crypto is not taxed. That means the tax rate is anywhere between 0 to 37 depending on your income tax bracket how you acquired your crypto and how long you held it. Long-term and short-term gains.

The proposed 20 tax on unrealized gains put forward by the US Department of Treasurys 2023 Revenue Proposal could potentially become a penalty for being successful according to Shehan Chandrasekera Head of Tax Strategy at crypto tax software specialist CoinTracker. American stocks and crypto holders are braced for another tax-themed body blow from the government with House Speaker Nancy Pelosi claiming that a wealth tax an unrealized capital gains levy on its way to Congress as early as this week after striking an agreement on a spending plan in the House. But reports in January suggested that unrealized gains would âœbe taxed at the same rate as all other incomeâ namely up to 37.

Cryptocurrency falls into three tax categories. This is great news for any crypto investor that has held their coins for a year or longer. If you had any losing stock or crypto losses when you sold you can offset your gains with those losses.

Crypto Tax Unrealized Gains Explained Koinly

The Us Government Wants To Tax Unrealized Gains Crypto Investment Tips Mtltimes Ca

Crypto Tax Unrealized Gains Explained Koinly

Crypto Tax Unrealized Gains Explained Koinly

Cryptosheets Google Workspace Marketplace

Crypto Tax Unrealized Gains Explained Koinly

Bitcoin Cryptocurrency Canadian Reporting Requirements

Confusing U S Tax Laws Lead To 5 Billion In Unrealized Crypto Losses

Crypto Tax Unrealized Gains Explained Koinly

Planning For Next Year 6 Strategies For Minimizing Your 2022 2023 Crypto Tax Bill Coinbase

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These R Taxbit

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

Understanding Crypto Taxes Coinbase

Crypto Tax Unrealized Gains Explained Koinly

The Us Government Wants To Tax Unrealized Gains Crypto Investment Tips Mtltimes Ca

8 Best Crypto Tax Software In Canada Jul 2022 Yore Oyster

Do I Have To Pay Taxes On Crypto Yes Even If You Made Less Than 600 Taxbit

A Guide To Cryptocurrency And Nft Taxes

Us Government Unrealized Gains Tax Plans Might Hit Crypto Billionaires Too